Opening a Bank Account

Has Never Been This Convenient

Samba Bank Limited brings you the ultimate banking experience of opening a bank account digitally without visiting a branch. Now you can be anywhere, at work, at home or on the go.

All you have to do is to simply visit www.samba.com.pk

– Fill in some basic account related information

– Upload identification and income support documents (as applicable) and Welcome yourself to an account power packed with a host of unparalleled branch banking services.

Opening a Bank Account

Has Never Been This Convenient

Samba Bank Limited brings you the ultimate banking experience of opening a bank account digitally without visiting a branch. Now you can be anywhere, at work, at home or on the go.

All you have to do is to simply visit www.samba.com.pk

– Fill in some basic account related information

– Upload identification and income support documents (as applicable) and Welcome yourself to an account power packed with a host of unparalleled branch banking services.

Set Up Your Bank Account

It will only take 10 minutes for you to fill this Digital Account Banking Form

To begin with, all you need is a camera enabled device and few important documents such as a valid ID Card, an Income Proof Document (as applicable) such as a Salary Slip or a Proof of Business.

Please ensure that your Mobile Number is registered against your ID

English Tutorial Video

Urdu Tutorial Video

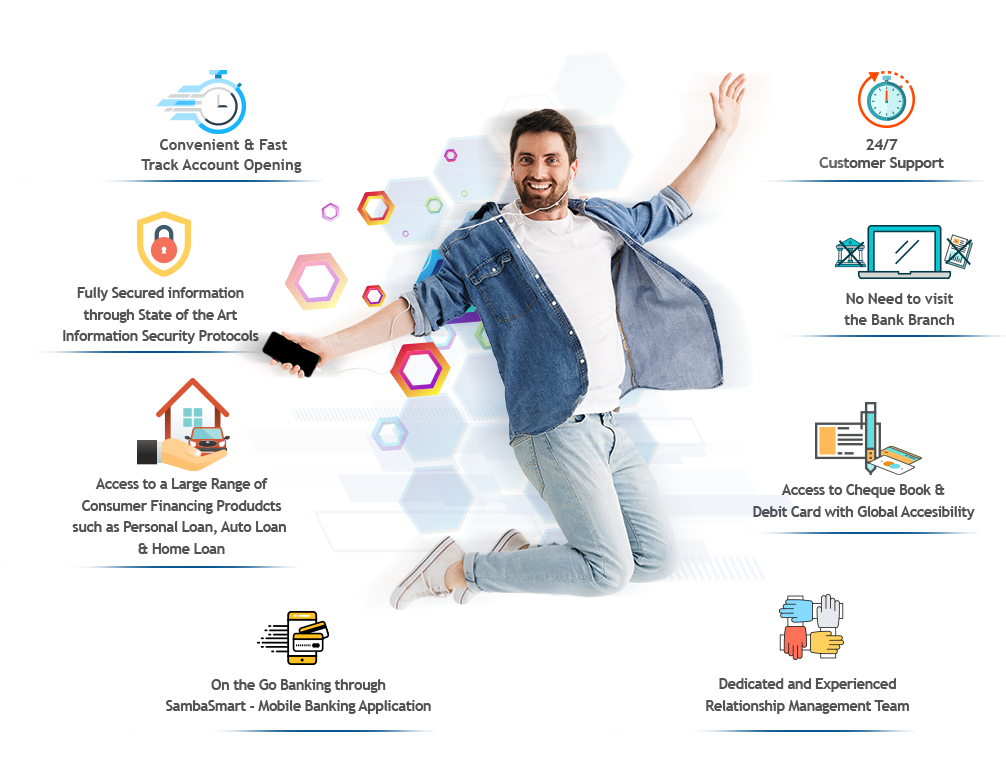

The Ultimate Banking Experience

Power Packed Bank Accounts with Access On The Go

Eligibility Criteria

All Resident Pakistanis

Salaried

Self Employed

Student

Housewife

Retired

Freelancers

Landlord

Minor

Documentation Requirements

The documentation required for submission for your account opening application are very easy and should be readily available with you at all the times. The list of document required to be uploaded online varies, depending upon whether you are salaried, businessman, retired, housewife, pensioner, etc..

Whereas Samba Bank Limited's account opening application clearly guides you regarding the upload of respective document, however for reference purpose, the list is attached

View List of documents

After your Digital Account Is Opened:

- As soon as your account is opened, you will receive a Welcome Email from our Head Office containing your account credentials and other useful information.

- You will also receive a call from our dedicated team to officially welcome you to Samba Bank Limited where you will be guided on how to use your account and what other services are available to you in our world of exciting banking services.

- Your account will be instantly activated after this call subject to complete verifications.

- A personalized Letter of Thanks (LoT) containing your account credentials will be sent to your registered correspondence address.

- Your Samba Debit / ATM Card & Cheque Book (Welcome Pack), if requested, will be dispatched on your registered correspondence address as soon as your account is funded with a minimum of PKR 10,000/- (or equivalent in FCY *)

- Debit / ATM Card will only be issued in case you have at least one PKR account with Samba Bank Limited.

- Upon receipt of your Welcome Pack, you are requested to please sign the Cheque Book acknowledgement slip and send us an picture of the same via return email.

Biometric Verification

- Now there is no need to visit the branch because you can send us your Biometric Verifications from the comfort of your home or your work place.

- You can simply visit your Google Play Store or Apple Store and download our exclusive application by the name of "Samba BVS"

- Once downloaded, please enter your National Identification (CNIC / SNIC) Number, place your fingers in front of the camera and our state of the art Biometric Verification Application will help you complete your Biometric Verification in less than a minute.

- In accordance with the SBP guidelines, if your Biometric Verification is not available in our records within 60 days of account opening, we will be constrained to block your account after serving a 10-day notice.