Non-Resident Rupee Value Account (NRVA) & Foreign Currency Value Account (FCVA)

Non-Resident Rupee Value Account (NRVA)

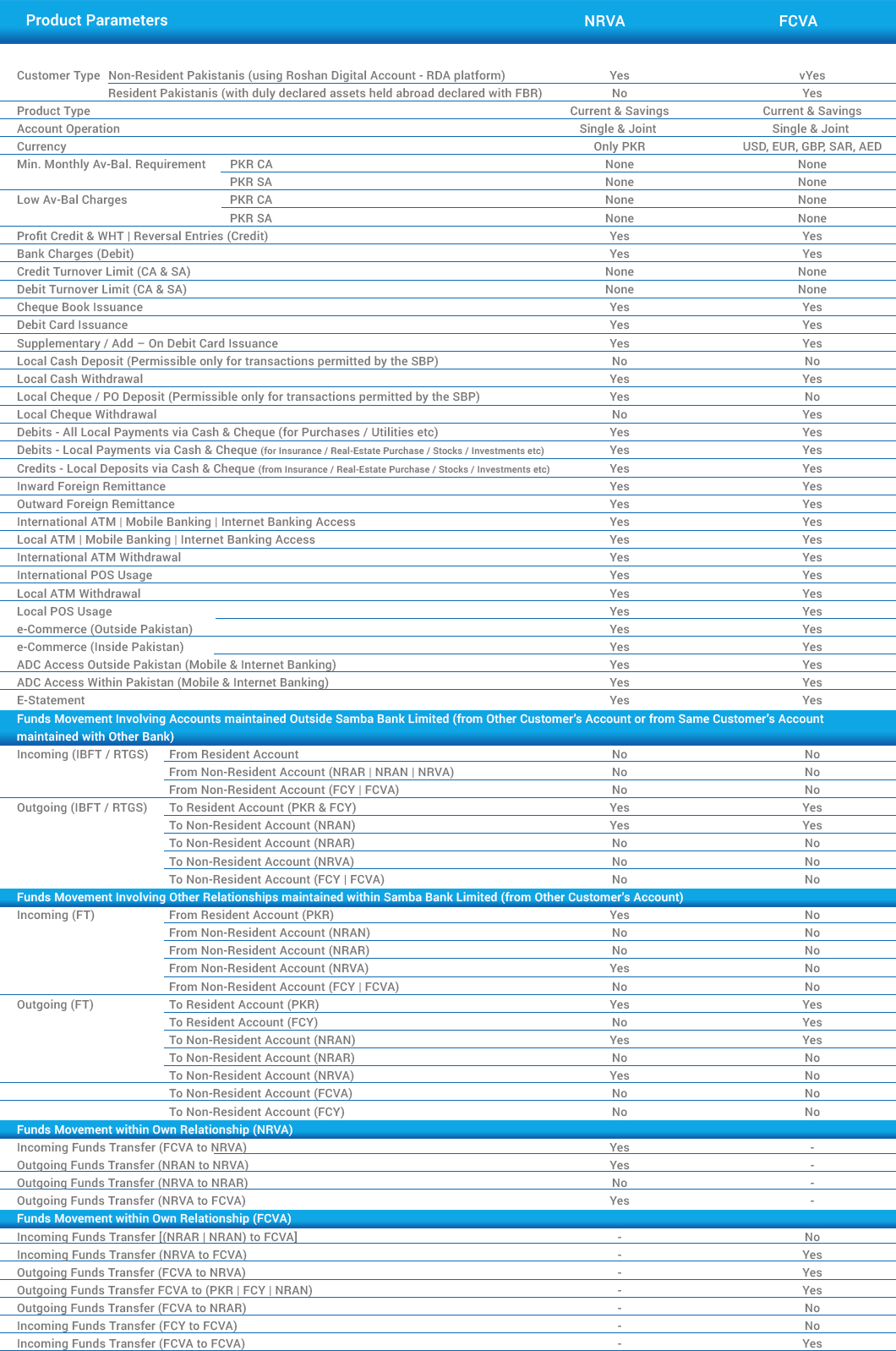

For facilitation of the Non-Resident Pakistani (NRPs) to open & operate PKR account through digital means and to invest in shares quoted on the Stock Exchange(s) in Pakistan, residential & commercial real estate, government of Pakistan debt securities and term / remunerative deposit products, the State Bank of Pakistan (as per FE Circular 01 of 2020) has introduced a repatriable PKR ‘NRP Rupee Value Account (NRVA)’

NRVA category accounts can be opened for the following category of customers:

Non-Resident Pakistanis (NRPs) *

Foreign nationals except those who have obtained work visa/permit to work in Pakistan

Firms, companies, etc. which are incorporated/registered outside Pakistan

Foreign Currency Value Account (FCVA)

Similarly, in order to facilitate the Non-Resident Pakistanis (NRPs) as well as Resident Pakistanis [who have assets abroad duly declared with Federal Board of Revenue (FBR)], for investment in foreign currency denominated government registered debt securities on repatriable basis, the State Bank of Pakistan (as per FE Circular 02 of 2020) has introduced a repatriable ‘Foreign Currency Value Account (FCVA)’

FCVA category accounts can be opened for the following category of customers:

Non-Resident Pakistanis (NRPs) *

Resident Individual Pakistani ** who has duly declared assets held abroad, as per wealth statement declared in latest tax return with Federal Board of Revenue (FBR)

* Individual Non-Resident Pakistani (NRPs) customers can open their Non-Resident Rupee Value Account (NRVA) & Foreign Currency Value Account (FCVA) using only the Roshan Digital Account (RDA) platform

** Individual Resident Pakistani customers can only open their Foreign Currency Value Account (FCVA) in USD by visiting any Samba Bank Limited branch in Pakistan.

Investment Permissibility

Through the NRVA, permissible investments under the relevant laws / regulations include:

- Registered Debt securities of Government of Pakistan (T-bills, PIBs, Sukuk and any other registered debt securities of the government including CDNS securities).

- Shares quoted on the stock exchange(s) in Pakistan.

- Residential and commercial real estate.

- Term / Remunerative deposit products of the AD (i.e. the bank) maintaining the account

Permissible credits in NRVA relates to investments include proceeds from disinvestment / sale / maturity of Government of Pakistan’s debt securities, residential and commercial real estate, quoted shares, term deposits, and profit / rent / dividend / interest on such securities / properties / shares / deposits received on account of investments made from the account

Through the FCVA, permissible investments under the relevant laws / regulations include:

- Government of Pakistan’s registered debt securities denominated in FCY only.

- Term deposit / Remunerative product scheme, denominated in FCY, of the same AD (i.e. the Bank)

Permissible credits in FCVA relates to dis-investment proceeds from the permissible investments made from the account.

Local Credits are allowed in NRVA and FCVA Accounts only in cases of transactions permissible by the SBP subject to submission of supporting documentation.